Table of Content

You can go back and modify your inputs if you wish to recalculate your eligibility. Loans against property / Home Equity Loan for Business Purpose i.e. Incidental charges & expenses are levied to cover the costs, charges, expenses and other monies that may have been expended in connection with recovery of dues from a defaulting customer. A copy of the policy can be obtained by customers from the concerned branch on request. It can take years to accumulate sufficient funds for buying a house. Make sure you provide all the details that the home loan provider will need to process your application.

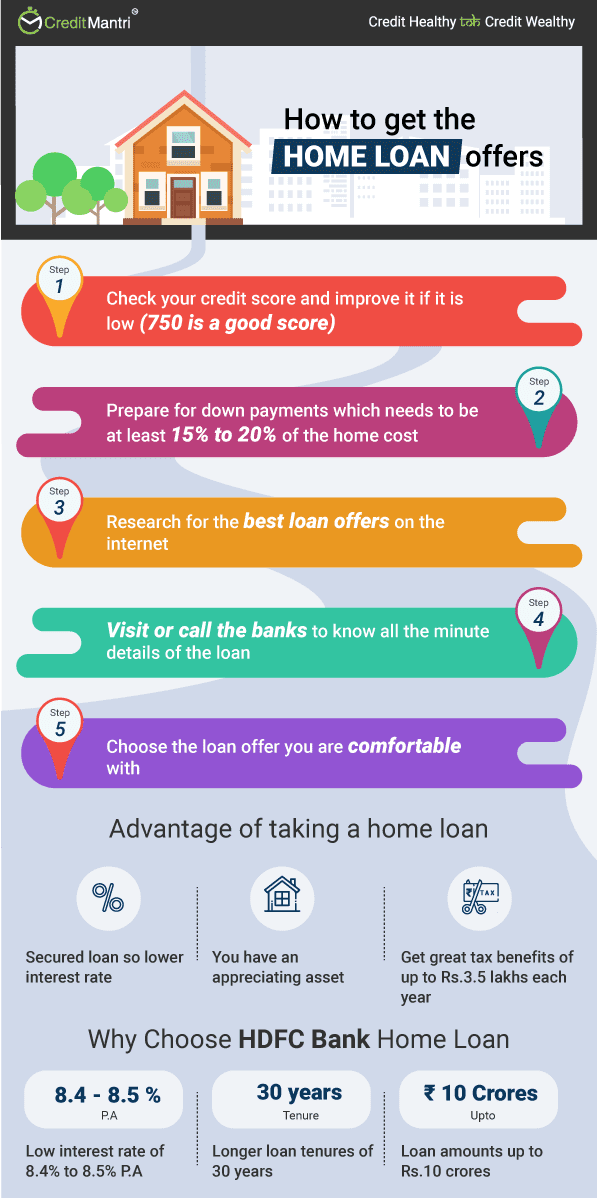

For a 30-year, fixed-rate mortgage, the average rate you'll pay is 6.60%, which is a decline of 3 basis points from one week ago. (A basis point is equivalent to 0.01%.) Thirty-year fixed mortgages are the most common loan term. A 30-year fixed mortgage will usually have a greater interest rate than a 15-year fixed rate mortgage -- but also a lower monthly payment. You won't be able to pay off your house as quickly and you'll pay more interest over time, but a 30-year fixed mortgage is a good option if you're looking to minimize your monthly payment. HDFC is India’s premier housing finance company offering a wide range of home loan products that are customized to your needs and can be comfortably repaid over a longer tenure.

Home Loan Providers

The Fed last week announced a 50 basis points interest rate increase, stepping down from the more aggressive75 basis points increasesof the previous four meetings. Mortgage rates dropped again last week on the news that inflation is trending in the right direction and that the Federal Reserve may be shifting on its monetary policy, Freddie Mac said. Look at your credit report to ensure there are no errors on it. Quotes displayed in real-time or delayed by at least 15 minutes. Following September's property cooling measures, Dr Tan noted that there were already dips in the secondary market transaction volumes.

The loan amount is limited to a maximum of Rs.50 Lac to meet personal and professional needs. The loan is extended to purchase a plot through direct allotment, and that is offered for resale. The types of rate applied in the HDFC Bank home loan are the Adjustable Rate for Home Loan and the Tru-fixed, in a combination of the Fixed and Floating rates. Apply online and experience hassle-free documentation to comply with the application process. Enjoy Adjustable Interest Rate starting from 6.75% per annum and women with preferential rates, depending on the amount.

How can I improve my chances of getting a home loan with HDFC?

A loan EMI calculator or interest rate calculator is one and the same thing. This easy-to-use online calculator lets you calculate your EMI in no time. All you need to do is enter the relevant details related to your loan, including the loan amount, interest rate, loan tenure, and processing fee. This will be followed by an amortisation table giving you a comprehensive breakdown of your payment schedule. Credible is a multi-lender marketplace that empowers consumers to discover financial products that are the best fit for their unique circumstances.

The fixed deposit advise of the deposit is available for immediate download by investors. With net advances of over Rs. 89,000 crores and a sizable deposit base of about Rs. 1,22,000 crore, the combined firm is now quite strong. The merged business will have a financial sheet of more than Rs. 1,63,000 crore. As a result of the merger, HDFC Bank now has a significantly larger branch network, customer base, geographic reach, and pool of trained labour.

Looking for a home loan?

One can increase one’s chances of getting a higher loan amount by adding a co-applicant. If the co-applicant is female, HDFC Home loans will offer one better rate of interest rates on one’s home loan. Any change in the HDFC Home Loan interest rates will be informed to the borrowers in writing. HDFC offers a special discount of 0.05% on interest rates for female borrowers.

Only individual depositor/s, singly or jointly, can nominate a single person under this facility. In case the deposit is placed in the name of a minor, the nomination can be made only by a person lawfully entitled to act on behalf of the minor. Power of Attorney holder or any person acting in representative capacity as holder of an office or otherwise cannot nominate. Nominee's name will be printed on the Fixed Deposit receipt, unless mentioned otherwise. Interest on your deposits will be credited directly to your account through National Automated Clearing House. Kindly note that HDFC Sales is in the business of financial distribution and is a registered agent with HDFC Limited for promoting their deposit products.

Currently HDFC home loan interest rates start at 8.60% p.a for floating interest rate variant. The special scheme offers 20 bps discount on standard HDFC home loan rate. You can opt for floating/adjustable rate or trufixed loan as per your requirement. Check what are the interest rates and processing fees of HDFC Ltd Home loans in Thiruvalla. You can compare HDFC Ltd. with other home loans banks in Thiruvalla to get better offers on housing loans.

In case of request for premature withdrawal after the expiry of three months, the rates given in the following table shall apply. Yes, tax benefit is applicable on Home Loan from HDFC Bank as per the Indian Income Tax Act 1961. So, before applying for HDFC Ltd Home Loan, compare HDFC Home Loan interest rates offered by other top banks. The hike in the FD rate comes close on the heels of State Bank of India's decision to increase the interest rate of fixed deposits. No, you are not permitted to deposit any more funds since you are only permitted to deposit funds at the time of account establishment.

During fixed interest rate regimes, the foreclose charge will be up to 2% per month. The applicable charges are clearly communicated during loan approval process. The balance transfer loans are offered with parallel benefits as offered on fresh home loans. Currently HLBT interest rates are starting at 8.20% for the maximum of 30 years.

Note that the plans mentioned may not be applicable for all the schemes.

Another important distinction is between fixed-rate and adjustable-rate mortgages. The interest rates in a fixed-rate mortgage are fixed for the duration of the loan. For adjustable-rate mortgages, interest rates are set for a certain number of years , then the rate adjusts annually based on the market rate. Though the Fed does not directly set mortgage rates, the central bank's policy actions influence how much you pay to finance your home loan. If you're looking to buy a house, keep in mind that the Fed has signaled it will continue to raise rates into 2023, which would likely continue to drive mortgage rates upward.

The average interest rates for both 15-year fixed and 30-year fixed mortgages decreased. The average rate of the most common type of variable-rate mortgage, the 5/1 adjustable-rate mortgage, also sank. The loan products are displayed In the following “Offers” tab and the eligibility, EMI, tenure, and interest rates are displayed, along with personal details already entered. Enhanced customer satisfaction has always been at the core of all HDFC product offerings. HDFC Depositors are serviced through its 420 inter-connected offices spread across India with instant services provided at 77 deposit centers. HDFC has set high benchmarks of service delivery on a continuous basis by providing electronic payment facility for interest payment, instant loan against deposit and many more.

The effective rate of interest of your HDFC Home Loan is determined according to HDFC Ltd internal costs of raising new funds. The HDFC Bank also hiked the interest rates on FD for senior citizens effective from 14 December 2022. HSPL and HSPL authorized recruitment agents/ agencies do not ask for payments from applicants at any point in the recruitment process. However, a minimum deposit of Rs. 25,000 is required for a minimum duration of more than six months.

This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products. The days of sub-3 percent mortgage interest on the 30-year fixed are behind us, and rates have so far risen beyond 7 percent in 2022. The average rate on a 5/1 ARM is 5.46 percent, adding 1 basis point over the last 7 days. You can save thousands of dollars over the life of your mortgage by getting multiple offers.

No comments:

Post a Comment