Table of Content

The New Generation Private Sector Banks, this was the first merger of two private banks. Shareholders of Times Bank got 1 HDFC Bank share for every 5.75 Times Bank shares, in accordance with the merger plan approved by the shareholders of both banks and the Reserve Bank of India. The HDFC Bank was established in August 1994 as ‘HDFC Bank Limited,’ with its registered office in Mumbai, India. In January 1995, HDFC Bank began operations as a Scheduled Commercial Bank. With customised solutions and have fulfilled over 9 million dreams over the last three and a half decades.

The average 15-year fixed-mortgage rate is 6.00 percent, up 9 basis points over the last seven days. Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions.

HDFC Bank Home Loans

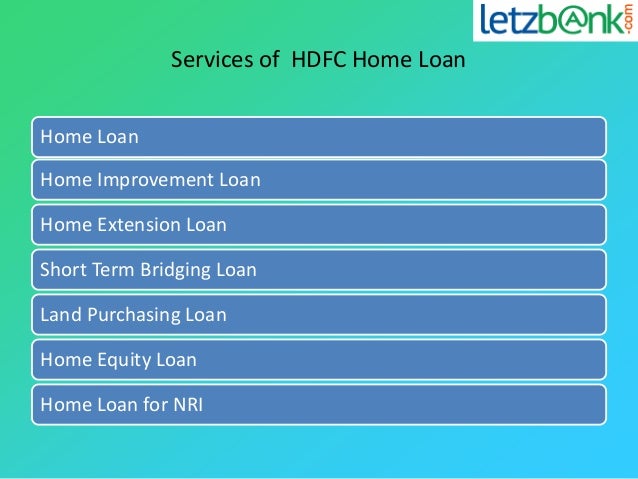

You can now apply for a home loan online in 4 simple steps with HDFC’s quick and easy apply online module. Applicants should consider these factors carefully before applying for a home loan with HDFC to increase their chances of loan approval. Your loan amount taken or sanctioned by the bank affects your interest rates. If a higher loan amount is taken, it has a higher rate of interest.

The charges for HDFC Home Loans to build, buy, extend, or renovate your house are described below. Therefore, it is prudent to ascertain the actual applicable rates from HDFC Bank before applying. Premature withdrawal will not be allowed before completion of three months from the date of deposit.

Approval & Disbursement of Home Loan

Rates could be materially higher when the loan first adjusts, and thereafter. The total amount you’ll pay in interest during the loan’s lifespan is $133,735. One important consideration when choosing a mortgage is the loan term, or payment schedule. The most common mortgage terms are 15 years and 30 years, although 10-, 20- and 40-year mortgages also exist.

Rates could be substantially higher when the loan first adjusts, and thereafter. The average rate for a 15-year, fixed mortgage is 5.99%, which is a decrease of 2 basis points from seven days ago. You'll definitely have a bigger monthly payment with a 15-year fixed mortgage compared to a 30-year fixed mortgage, even if the interest rate and loan amount are the same. But a 15-year loan will usually be the better deal, if you can afford the monthly payments. These include typically being able to get a lower interest rate, paying off your mortgage sooner, and paying less total interest in the long run. The limited period Special Interest Rate offer for Women customers (Salaried and Self-employed) and others is valid from 3 May 2021 to 31 October 2021.

Where are mortgage rates headed?

Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. "Low interest rates were the medicine for economic recovery following the financial crisis, but it was a slow recovery so rates never went up very far," says McBride.

Many banks immediately hiked the fixed deposit interest rates after the Reserve Bank of India this month raised the repo rate by 35 basis points to 6.25%. The latest ones to join the list are SBI, HDFC Bank, ICICI Bank and Kotak Mahindra Bank which hiked the fixed deposit interest rates this week. Existing home loan customers wishing to reduce or reset EMI or tenure can apply for HDFC Home Loan Balance Transfer. You can opt for lower HDFC Home Loan interest rate and adjust loan principal and tenure according to your requirements. HDFC’s diversified loan portfolio caters to the needs of the non-housing segment. Be it the purchase of a commercial property or funding of personal or business expenses, we offer several...

The detailed terms and conditions as stipulated by the financial service providers for their respective products shall be applicable. You should read the same in detail before concluding any transaction. Senior citizens, who are 60 years of age or older, are offered an additional 0.25% p.a.

RBI has instructed banks to bring down rates for all customers. However, bank lower prevailing interest rates for new customers and changes them later on with changes in the financial market. Older customers continue paying the interest rate set for them during the initial stages and do not enjoy the privilege of the lower interest rate extended to new customers. When interest rates come down, the EMI in a floating rate home loan is often kept stagnant and only the tenure of the loan is altered. Fixed rate loans also have terms and conditions reset clauses and riders which can affect the interest rate when there are market fluctuations. Though the nature of the clause depends on the Bank’s regulations after a fixed period or with a sharp hike in interest rates the interest rates can be revoked.

HDFC Sales is not an Investment Advisor and does not provide any investment or financial planning advice. The information provided on our website is for informational purposes only and it should not be considered as financial advice. Please consider your specific investment requirements before choosing any investment or designing a portfolio that suits your needs.

Which is fixed for a term of two years only and is reset after this period. Details of ongoing loans of the individual and the business entity including the outstanding amount, instalments, security, purpose, balance loan term, etc. Once you avail a HDFC home loan, you can access your home loan account online on our website. You can download account statements, interest certificates, request for disbursement and do much more.

It will change as per the down payment for the loan and the loan amount. As such, either the EMIs will be increased or decreased, or the loan repayment may get extended. In some situations, there may be a change in both EMIs and the loan tenure. Currently you can apply for HDFC home loans with interest rates starting from 8.60% p.a.

In case, your spouse or family members have a stable income source, you can make them as a co-applicant of the loan. Hence the combined earnings of applicants will increase the loan amount eligibility and promise a good HDFC housing loan interest rate. Besides factors like borrower's occupation, income, repayment capacity, type of property and existing relationship with the bank will also impact effective interest rate. This amount is paid during the period till the full disbursement of the loan. Your actual loan tenure — and EMI payments — begins once the Pre-EMI phase is over i.e. post the house loan has been fully disbursed. The maximum repayment tenure depends on the type of housing loans you are availing, your profile, age, maturity of loan etc.

No comments:

Post a Comment